How to find future value of stock?

FV = PV * (1 + r)^N

FV=PV(1+i)n

In this formula, the superscript n refers to the number of interest-compounding periods that will occur during the time period you're calculating for.

For example, assume we have $1,000 today and we invest it at 5% for one year. In one year, we will have $1,050.00. In this simple example, the future value is calculated as the present value*(1+the interest rate), or 1000*(1.05). If we made the same investment for two years, the future value would be $1,102.50.

Answer and Explanation: The future value of a $1000 investment today at 8 percent annual interest compounded semiannually for 5 years is $1,480.24.

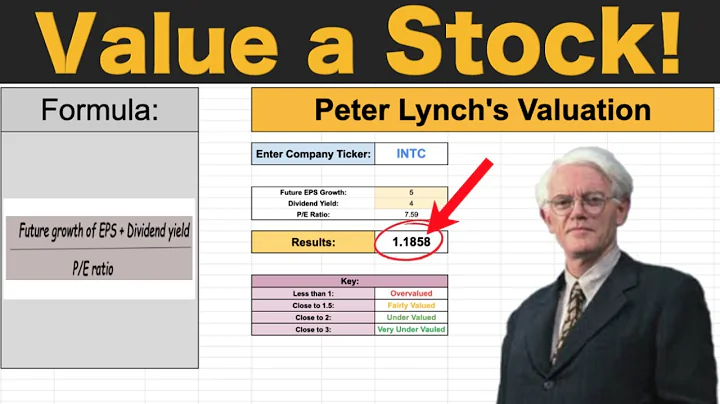

Price-to-Earnings (P/E) Ratio

It provides insight into how much investors are willing to pay for each dollar of earnings generated by a company. To calculate the future stock price using the P/E ratio, one can project the future EPS based on expected earnings growth and then multiply it by the desired P/E ratio.

DCF is the most widely accepted method to calculate the fair value of a company. It is based on the premise that the fair value of a company is the total value of its future free cash flows (FCF) discounted back to today's prices. FCF is the company's incoming cash flows less its cash expenses.

Price-to-earnings ratio (P/E): Calculated by dividing the current price of a stock by its EPS, the P/E ratio is a commonly quoted measure of stock value. In a nutshell, P/E tells you how much investors are paying for a dollar of a company's earnings.

The future value of $800 at 8 percent after six years equals $1,269.50. Where, PV = Present value = $800. i = interest rate = 8%

$5,921.50. What is the future value of $2,928 invested for 8 years at 4.5 percent compounded annually?

After 20 years, your $50,000 would grow to $67,195.97. Assuming an annual return rate of 7%, investing $50,000 for 20 years can lead to a substantial increase in wealth.

What is the most accurate stock predictor?

AltIndex – We found that AltIndex is the most accurate stock predictor for 2024. Unlike other providers in this space, AltIndex relies on alternative data points, such as social media sentiment and website analytics. It also uses artificial intelligence to convert its findings into risk-averse stock picks.

The formula for computing futures prices can be expressed as: Futures Prices = Spot Price * [1 + (RF * (X/365) - D)], where: The risk-free return rate, RF, signifies the rate one can earn throughout the year in a perfect market.

- Tata Consultancy Services Ltd. IT - Software.

- Infosys Ltd. IT - Software.

- Hindustan Unilever Ltd. FMCG.

- Reliance Industries Ltd. Refineries.

The future value formula is FV=PV(1+i)n, where the present value PV increases for each period into the future by a factor of 1 + i. The future value calculator uses multiple variables in the FV calculation: The present value sum.

There are two ways of calculating the FV of an asset: FV using simple interest, and FV using compound interest.

Warren Buffet Fair Value Calculator. Warren Buffett calculates a stock's fair value based on the future cash flows it will generate, minus an appropriate risk premium.

409A valuations by independent appraisers are the primary IRS-accepted way to determine the current fair market value of a private company's common stock. FMV influences the price employees, contractors, and other common stock option recipients must pay to purchase their stock options (also known as the strike price).

Typically, the average P/E ratio is around 20 to 25. Anything below that would be considered a good price-to-earnings ratio, whereas anything above that would be a worse P/E ratio.

The most common way to value a stock is to compute the company's price-to-earnings (P/E) ratio. The P/E ratio equals the company's stock price divided by its most recently reported earnings per share (EPS). A low P/E ratio implies that an investor buying the stock is receiving an attractive amount of value.

- Earnings per Share (EPS) Earnings per Share (EPS) is a metric that tells us how much profit a company generates per share. ...

- Price to Earnings Ratio (PE Ratio) ...

- Return on Equity (ROE)

How much is the future worth of the 35000 after 12 months if it is invested at simple interest of 3% per month?

SOLVE EACH PROBLEM COMPLETELY

of 3% per month? - Future worth of 35000 after 12 months is 47600.

Answer. - At 7% compounded monthly, it will take approximately 11.6 years for $4,000 to grow to $9,000.

$121 is the future value of $100 in two years at 10%. Also, the PV in finance is what the FV will be worth given a discount rate, which carries the same meaning as interest rate except applied inversely with respect to time (backward rather than forward.

- future value = present value x (1+ interest rate)n Condensed into math lingo, the formula looks like this:

- FV=PV(1+i)n In this formula, the superscript n refers to the number of interest-compounding periods that will occur during the time period you're calculating for. ...

- FV = $1,000 x (1 + 0.1)5

The future value of $10,000 with 6 % interest after 5 years at simple interest will be $ 13,000.