Why is home insurance so expensive in the US?

Homes in high-risk areas typically have higher premiums. Insurance companies assess the risk associated with your area by looking at the likelihood of severe weather, such as floods, wildfires, and hurricanes, local crime rates, and your home's proximity to a fire station.

Why did your homeowners insurance go up? (Updated May 2024) The increase in expensive natural disasters and higher-than-average labor and construction costs have caused home insurance rates to skyrocket. Pat Howard.

- Florida: $10,996.

- Louisiana: $6,354.

- Oklahoma: $5,444.

- Texas: $4,456.

- Mississippi: $4,312.

- Colorado: $4,072.

- Nebraska: $3,962.

- Alabama: $3,939.

According to data we obtained from Quadrant Information Services, the national average cost of home insurance coverage is $2,511 per year for a standard homeowner in the United States. The rate that you will actually pay depends on a variety of factors that indicate how risky you and your home will be to insure.

Factors such as longer repair times and more expensive rental car costs are resulting in rising prices, according to a report by the American Property Casualty Insurance Association. Also, cars are becoming costlier to fix.

State Farm is the cheapest home insurance provider on our list, with policies averaging $174 per month, so we named it our pick for new homeowners.

The rising cost of building materials, supply chain issues and unfilled jobs are driving up the costs of home repairs.

On average, homeowners will have to pay around $4,140 annually, or $345 monthly, for Homeowners Insurance on a $600,000 home. Your premium will be based on, firstly, the coverage total and, secondly, your policy structure.

Unfortunately, paying off your mortgage doesn't reduce homeowners insurance premiums. You will no longer be required to carry home insurance as it isn't legally mandated, but your home will still require the same level of coverage to protect you from financial losses.

States have different rules regarding what a standard home insurance policy includes. Exclusions or separate deductibles for wind storms are common and greatly impact the average rate. Standard home insurance policies in Hawaii exclude damage from hurricanes, which is why home insurance is so cheap in Hawaii.

What state has the highest insurance rate?

Average car insurance costs by state can vary from as much as $274 per year to $3,643 per year depending on the coverage you choose. Michigan is the state with the highest average car insurance rates at $3,643 per year for full coverage and $1,360 per year for minimum coverage.

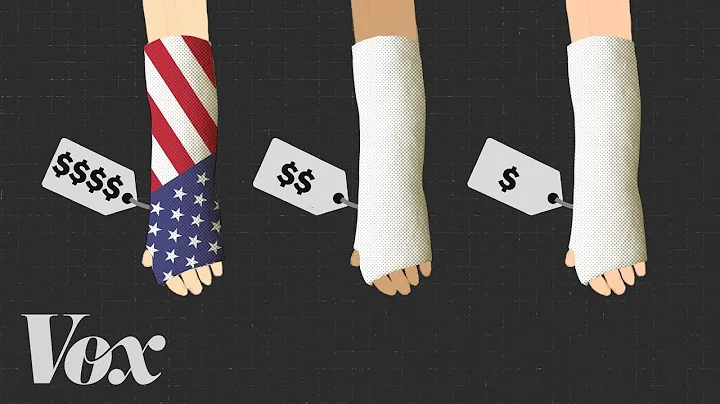

Healthcare system complexity

This complexity often results in administrative inefficiencies, increased paperwork, and higher operational costs for both healthcare providers and insurers. These added expenses are eventually passed on to consumers in the form of higher insurance premiums, deductibles, and copayments.

While the majority of people in the United States have private health insurance, primarily through an employer, others obtain coverage through programs offered by the government.

State Farm is the largest home and auto insurance company in North America, capturing 17.79 percent of the home market and 18.31 percent of auto.

Inflation is partly to blame for those big payouts. The cost of fixing or replacing damaged homes and cars has jumped sharply in recent years as a result of rising labor and material prices.

According to our rate averages, the most expensive car insurance often comes from The Hanover Insurance Group. The company's average rates for both liability and full-coverage insurance can be more than 400% higher than the national average.

Is $2,500 a good home insurance deductible? As long as you're comfortably able to pay it in the event of a claim and don't mind footing the bill for smaller losses (say, a broken pipe or stolen laptop), $2,500 is a fine deductible to choose.

The average home insurance cost by state varies with the nationwide average coming in at $2,601 a year. The cheapest state for home insurance is Hawaii at $613 a year, and the most expensive state is Oklahoma at $5,858 a year.

USAA, Nationwide, Travelers, Erie, Geico and Progressive are the cheapest car insurance companies nationwide, according to our analysis.

Typically, the higher your credit rating, the less you will pay for home insurance in the states where credit is considered a rating factor. Although it is only one factor in setting rates for home insurance, data shows that the credit-based insurance score is an important one.

Is homeowners insurance tax deductible?

Unfortunately, homeowners insurance premiums aren't tax deductible, unless the property creates a source of income.

Risk Assessment: Balancing Protection and Peril

The foundation of insurance pricing lies in risk assessment. Insurers like USAA meticulously evaluate various risk factors, including geographical location, property value, and potential hazards, to determine appropriate premium rates.

A high-value home is typically categorized as a home with a value above $750,000, but some policies may only cover homes worth $1 million and up. For homes of this value, a standard homeowner insurance policy may not provide enough coverage for the home and the contents within, such as antiques, art and jewelry.

Mortgage Insurance Premiums: How They Work

If your home loan is for $200,000, expect to pay (or roll into your loan) $3,500 for UFMIP at the time of closing. FHA loans also require you to pay an average of 0.85% of your home loan for MIP throughout the duration of your mortgage.

But in general, the cost of private mortgage insurance, or PMI, is about 0.5 to 1.5% of the loan amount per year. This annual premium is broken into monthly installments, which are added to your monthly mortgage payment. So a $300,000 loan would cost around $1,500 to $4,500 annually — or $125 to $375 per month.